Recurring donor-advised fund contributions, meetings focused on you, and what’s up in Washington

|

Greetings from the Peninsula Community Foundation!

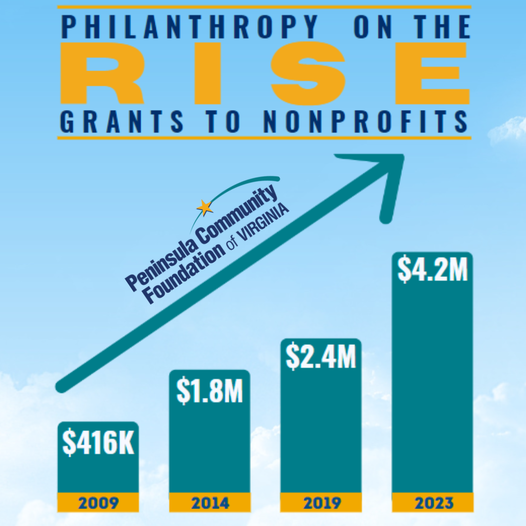

We hope you are doing well! Do you know there are more than a thousand community organizations in our area that are classified as nonprofit? We regularly work with between 200 and 300 of these important programs. They serve our community in so many ways from health care, to childcare, to pet care and everything in between. How many community programs do you know and how many do you regularly support? Last year you and other philanthropists, working with the Peninsula Community Foundation, provided more than $4 million to support this important work. Your commitment to the community, along with the commitment of all our supporters, is making a difference. Thank you. |

Here’s what’s coming up in this issue:

Thank you for the opportunity to work together! We are grateful!

Michael Monteith, CEO

Peninsula Community Foundation of Virginia

- Getting into the habit of setting up regular contributions to your donor-advised fund helps your financial planning and also helps you support your favorite causes well into the future. We’re sharing tips and benefits to boost your philanthropic nest egg.

- The team at the community foundation welcomes the opportunity to meet in person, or over Zoom if that is easier for you. Charitable giving is important and everyone’s approach to philanthropy is different. We take our relationships with fund holders seriously and we strive to understand and serve your unique charitable giving priorities. Personal service is what you can expect when you meet with our team.

- Donor-advised funds are just one of many types of funds you can establish with the community foundation. Donor-advised funds are popular because of the flexibility they offer to help you support the important work of your favorite charities. Our team stays up to date on the latest donor-advised fund trends and developments, and we’ll keep you up to date too!

Thank you for the opportunity to work together! We are grateful!

Michael Monteith, CEO

Peninsula Community Foundation of Virginia

Full circle: Grow your philanthropy through recurring giftsDeveloping a practice of regular contributions to your donor-advised fund not only allows you to systematically build a philanthropic nest egg for your annual giving to favorite charities, but also paves the way for your future legacy bequests. Whether your normal contributions are monthly, quarterly, semi-annually, or annually, the consistency delivers many benefits. For instance:

|

- Recurring giving to your donor-advised fund also helps build ultimate capacity to ensure that your principles and dedication to altruistic endeavors endure long beyond your lifetime. Many fund holders at the community foundation have included provisions in their donor-advised fund documents to leave all or a portion of the donor-advised fund remaining at their death to an unrestricted or area of interest fund that we manage.

- Talking about your recurring support through the community foundation helps to create a giving culture within your family. Over time, your children and grandchildren will learn that philanthropy is an important family tradition and that charitable giving is a critical source of funding for programs that improve the quality of life for so many people in our region. Your donor-advised fund at the community foundation offers ongoing flexibility to fulfill your own charitable goals as well as the goals of the next generation.

Our team at the community foundation is happy to work with you and your advisors to determine the best way for you to make regular contributions to your fund, especially if your priority is to give highly appreciated stock to take advantage of the opportunity to avoid income tax on capital gains.

We look forward to talking with you about how recurring donations to your existing donor-advised fund (or a new donor-advised fund if you’re considering it) might be a fit for you and your charitable plans.

Our door is open: What happens when you meet with the teamWe are honored to work with generous individuals and families who’ve established funds to support the causes they care about. We’re also inspired by those of you who are getting to know the community foundation and considering establishing a donor-advised or other type of fund.

Wherever you are in the stages of your philanthropic planning, the team at the community foundation is here for you and considers our relationship to be personal. That’s why we welcome the opportunity to meet with our fund holders and prospective fund holders. Here are a few insights into what those meetings are all about: |

- You can expect personal, dedicated service. Unlike financial institutions' donor-advised fund platforms where access to a dedicated donor services team can be rare, the staff at the local community foundation is here to help you every step of the way along your charitable giving journey. Our team is happy to meet with you one-on-one, and we are also happy to join a meeting with you and your legal, tax, or financial advisor to assess your current situation and determine the best charitable tax strategy for you. This includes evaluating the best assets to give to your fund or funds at the community foundation, including publicly traded stock and even other noncash assets such as real estate or closely held stock.

- We care about your intentions for your fund. The team at the community foundation wants to understand the areas of interest that are a priority for you, whether that’s the arts, health care, social services, the environment, education, community development, or something else. We also want to understand the role you envision for the successor advisors you’ve named in the fund documentation, such as your children, who will make decisions about the fund when you are no longer living or able to manage the fund yourself.

- We make the paperwork a breeze. As you know if you’ve already established a donor-advised fund with us, the paperwork is straightforward and not at all cumbersome. As we’re exploring updating your existing donor-advised fund, setting up a new donor-advised fund, or adding additional types of funds to your portfolio, we’ll prepare simple documentation to capture your wishes, collect important contact information, and address your vision for your fund or funds both during and after your lifetime.

- We’re always here to strategize about your giving options. As you periodically review your assets and financial situation with your advisors, keep an eye out for appreciated assets that could be ideal to give to your fund or funds at the community foundation because of the potential capital gains tax savings. The community foundation can work with you and your advisors on contributions of a wide variety of assets to help you achieve your tax and estate planning goals. We are happy to go over the appraisal and documentation requirements for gifts of nonmarketable assets such as closely-held stock and real estate.

- We’ll let you know about educational opportunities and gatherings with other fund holders. During our meeting, we’ll share a calendar of upcoming events and ways you can learn more about the causes you care about and what’s going on in the community overall. Our team is here to help you stay up-to-date and on the various ways you can support the community by working with the community foundation and partnering with other fund holders.

Thank you for your commitment to philanthropy! If you’re already a fund holder, we are grateful that you’ve made the choice to organize your giving by working with the community foundation. If you’re considering getting started, we look forward to continuing the conversation! In either case, we look forward to seeing you soon!

News from Washington: An update on donor-advised fundsIn our last newsletter, we shared that our team is closely tracking the IRS’s proposed regulations concerning donor-advised funds, issued in November 2023. Certainly these regulations are just “proposed”; it is unclear whether and to what extent they will become final.

If you routinely read financial publications, you may have seen articles about these proposed regulations and speculation about what they might mean for charitable planning. At this point, it is anyone’s guess! You can rest assured that we are on top of the issues, and we will update all of our fund holders as more information becomes available. Indeed, you may have seen the news that the IRS has scheduled public hearings on the proposed donor-advised fund regulations, set for May 6, 2024, so it’s not likely we’ll hear anything definitive for several months. |

In the meantime, you might enjoy reading up on donor-advised funds and the many ways they can help grow philanthropy. The Donor Advised Fund Research Collaborative’s recently released study of donor-advised funds is full of statistics and insights about the popularity of donor-advised funds and how they help grow philanthropy.

We'll keep you posted!

We'll keep you posted!

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

For more information about establishing a fund, please [email protected]/757.327.0862